SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

Marty, your obsevation is astute and sound. I think many are staying too long at the table, and are now relying on hope instead of being realistic.

In too deep to get out now... There is a term for it; "Equity Rescuing."

That is why Vegas can afford to keep all those lights and fountains going.

What if Sept - Dec was just a bull run inside a bear market? We may be headed for some tough times. If so, I think I know enough now to spot the trend, and sit it out, and maybe still find a few small rallies along the way.

However, what do I know? Still have a long way to the first million

|

Fri Apr 22, 2005 5:36 pm

Fri Apr 22, 2005 5:36 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| Sitting it Out |

|

|

Sky,sitting it out is no fun. I wish I could be more optimistic. I think you hit the nail on the head. We have just witnessed a bull run within the context of a huge secular bear market. If this is true then the real hurting hasn't even started yet. There will be some trading opportunities on the way down but you have to sell on the way up otherwise if you wait to long you could get caught selling in a falling market, never much fun, as it makes for a long day, 4:00pm never comes. I love trading but when risk is high you just have to sit on your hands most of the time. Bonds (F-fund) can do well in a slowing economy providing we are not in a high inflation environment. The F-fund looks toppy to me right now though so I'm holding off. Next week should be very interesting especially if crude goes to $60 a barrel! I don't think being in equities will be productive should that happen. Marty.

Top Dog for March and May 06!

|

Fri Apr 22, 2005 5:52 pm

Fri Apr 22, 2005 5:52 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| Happy Bulls! |

|

|

The bulls are happy today, but so far I am not impressed. We are still below 20 day exponential moving averages and downtrend lines. Although we are up today, probably because of earnings reports, higher energy prices are putting a damper on advances. I think if energy prices could go down here, we could have a descent rally forthcoming, but so far it hasn't happened. Tomorrow will be an important day. We're either going to go thru 10,300 (Dow), 1170 on the S&P500 to the upside or we're going back down for a retest of the previous low. I don't know which way we'll go but for now I prefer to wait it out. Have a great day! Marty.

Top Dog for March and May 06!

|

Mon Apr 25, 2005 4:35 pm

Mon Apr 25, 2005 4:35 pm |

|

|

Wheels

Preferred Member

Cash: $ 21.52

Posts: 106

Joined: 17 Mar 2005

Location: Nashua NH

|

Looks like the I fund will be nearly flat today. EFA is up slightly but the EAFE is down .158% in U.S. dollars.

Dave

|

Mon Apr 25, 2005 7:28 pm

Mon Apr 25, 2005 7:28 pm |

|

|

rangerbob

Preferred Member

Cash: $ 40.60

Posts: 153

Joined: 21 Apr 2005

Location: arizona

|

amazing. i put everything i had into the c and i last week. god really does watch over the foolish.

now if i can just figure how to get out in time.......

|

Mon Apr 25, 2005 11:00 pm

Mon Apr 25, 2005 11:00 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| No Follow Thru Yet! |

|

|

We need volume and followthru. Don't see it yet. Still below 20 day exponential moving averages. We should be flying today with the oil down, and a good housing report and IBM buyback program. Staying 100% G until a breakout occurs, as we are still in a basing phase. Marty.

Top Dog for March and May 06!

|

Tue Apr 26, 2005 3:55 pm

Tue Apr 26, 2005 3:55 pm |

|

|

Jonathan

Member

Cash: $ 4.05

Posts: 20

Joined: 22 Apr 2005

|

| Orders for durable goods plunged in March |

|

|

I'm guessing it's going to be a rough day for equities.

[url=http://www.marketwatch.com/news/story.asp?guid={2F581312-053F-4382-88AA-BE67BCD5C017}&siteid=mktw]U.S. March durable goods orders down 2.8%[/url]

quote:

WASHINGTON (MarketWatch) - U.S. orders for durable goods declined 2.8% in March, the largest drop since September 2002, the Commerce Department reported Wednesday.

Economists surveyed by MarketWatch were expecting orders to rise 0.3%.

This is the third consecutive month orders for durable goods have fallen...

|

Wed Apr 27, 2005 12:49 pm

Wed Apr 27, 2005 12:49 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

|

|

|

Good morning! I think all this volatility has bruised the markets, and the floor is dissolving.

How much good news over how long a period will it take to turn things around? The more I hear, the more I am concerned that we are loosing ballast and drifting down towards 2002 levels.

On the next positive day, I will probably move my remaining equities (about 20%) into the G fund so I can protect capital and further reduce risk until the trends begin to reverse and start to show some gains.

This is the big difference for me as opposed to previous years. I would buy and hold equities, never used the G fund for the first 10 years, and suffer the losses of down trends, which offset some of the gains. Now I am conserving during the down swings, so I should realize stronger results than my previous Buy and Hold approach.

The trend is a friend... I will probably miss the peaks, but I should also avoid the valleys. I know I am already in better shape this year than I would have been otherwise.

Stay alert and watchful! There be bears in the forest!

|

Wed Apr 27, 2005 2:18 pm

Wed Apr 27, 2005 2:18 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| No Light at the End of This Tunnel! |

|

|

Hi Sky, welcome Jonathan; I'm staying 100% G, as this equity turbulence may get a lot worse before getting better. Should we break 10,000 on the Dow, or 1135 on the SPX we could have quite a meltdown. I'm not willing to risk capital right now, I'll let others, risk theirs. The trend is down, we have to acknowledge it, and until we have true capitulation, we cannot start a new uptrend. So far there still is to much complacency. I'm not even in the market and I'm feeling anxious. When the S&P 500 hundred hits 1100 then we may start to see some real basing but for now, I'd rather collect interest. Marty.

Top Dog for March and May 06!

|

Wed Apr 27, 2005 2:56 pm

Wed Apr 27, 2005 2:56 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

That's it, just too much risk right now. I am with you on this one Marty, I just don't think there is much chance of a rally in the near term, so I moved today instead of waiting a couple more days. I hate to loose even

a little on 20% of my portfolio, so I am all G with just a little F for tomorrow.

There will be better days, the sun will shine again, and all will be well, However, right now the bears are eating all the unicorns, dolphins and butterflies and have kicked over the pot at the end of the rainbow  . .

Last edited by SkyPilot on Wed Apr 27, 2005 10:09 pm; edited 1 time in total |

Wed Apr 27, 2005 4:27 pm

Wed Apr 27, 2005 4:27 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| False Rally! |

|

|

Oil report comes out showing crude inventory unexpectedly high, but gasoline inventory lower, so the market is currently rallying. Don't buy it! The SPX could go up to 1170 but I would short it. There is so much overhead resistance as the index has completed a head and shoulders top with the neckline at about 1164. It would take massive buying to plow thru there. It could happen but I doubt it not with oil over $50 a barrel. I missed the little breakout in the AGG chart today. May pick some of that up tomorrow as it is currently performing the best. Nice catch Sky, hopefully bonds will continue to outshine near term. This market just can't get out of it's own way! Marty.

Top Dog for March and May 06!

|

Wed Apr 27, 2005 4:36 pm

Wed Apr 27, 2005 4:36 pm |

|

|

Wheels

Preferred Member

Cash: $ 21.52

Posts: 106

Joined: 17 Mar 2005

Location: Nashua NH

|

My 2005 timing strikes again. Since I moved everything into the I fund last week, the C fund is clobbering the I fund. The EAFE is off almost a percent in U.S dollars today while the C fund is up about 1/2%. You can't blame the dollar today either because while the dollar index might be up slightly, the EAFE is actually slightly better in U.S dollars today than in local currencies.

http://www.msci.com/equity/index2.html (you have to change the date to the 27th yourself, I don't know why it doesn't do it automatically).

Dave

|

Wed Apr 27, 2005 6:34 pm

Wed Apr 27, 2005 6:34 pm |

|

|

Wheels

Preferred Member

Cash: $ 21.52

Posts: 106

Joined: 17 Mar 2005

Location: Nashua NH

|

Asia closed mixed. European shares have turned south and dollar futures are up. Another shitty day for the I fund.

Dave

|

Thu Apr 28, 2005 1:02 pm

Thu Apr 28, 2005 1:02 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| What Gives?! |

|

|

Oil down this morning, stock futures down this morning. Hmmm, I think the soft GDP number is taking precedence over the lower oil prices. If this is the case, and its still early, stocks could be in big trouble as the economy weakens. F-Fund here I come, the uptrend may continue further, as bond yields come down. One caveat though, if yields come down, that will help stocks sometime down the road, but still to early to tell when. Will monitor this morning to see what gives. Marty.

Top Dog for March and May 06!

|

Thu Apr 28, 2005 1:27 pm

Thu Apr 28, 2005 1:27 pm |

|

|

Jonathan

Member

Cash: $ 4.05

Posts: 20

Joined: 22 Apr 2005

|

| Re: Charting the G fund |

|

|

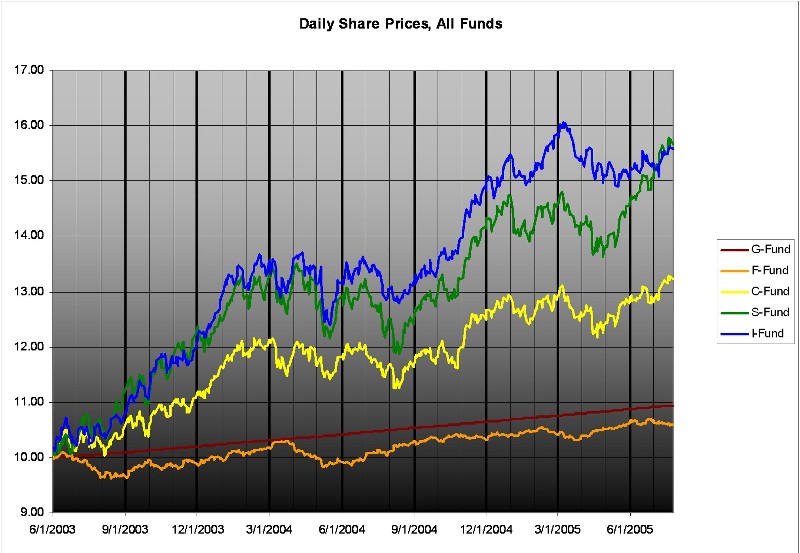

quote:

Originally posted by sarah

BTW, there is a cool website that helps you to chart all of the TSP funds, including the G fund. It's called tspmoney.com (no, I don't own it.)

Here's one of mine, for what it's worth, current as of yesterday's fund values (Excel):

|

Thu Apr 28, 2005 1:42 pm

Thu Apr 28, 2005 1:42 pm |

|

|

|