martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| F-Fund Reigns! |

|

|

Going 50%F, 50%G effective tomorrow. Slowing economy, flattening yield curve, do I smell recession?! Stocks are oversold, but I don't think the rally will have legs, I'll place my bet here on bonds. Oil coming down may have more to do with a slowing economy rather than supply/demand ratios. Slower future earnings for company's will mean a weak stock market for the forseeable future so for now I'll just sit back and see what transpires. The higher risk I believe is being in stocks at this time. Marty.

Top Dog for March and May 06!

|

Thu Apr 28, 2005 2:18 pm

Thu Apr 28, 2005 2:18 pm |

|

|

Jonathan

Member

Cash: $ 4.05

Posts: 20

Joined: 22 Apr 2005

|

| Yield Curve |

|

|

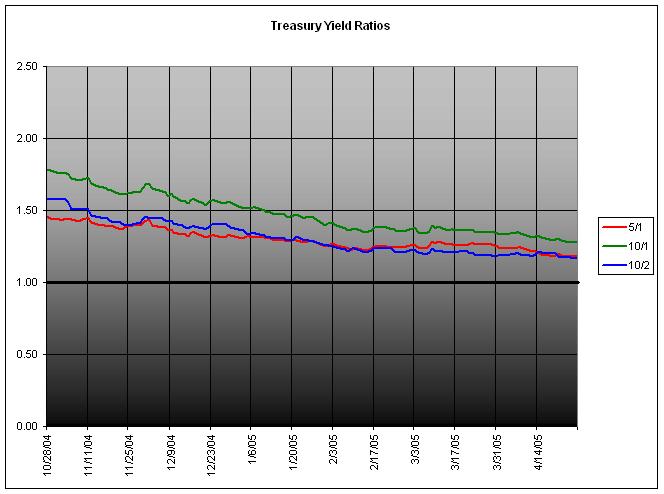

Here's the other item I track with a spreadsheet: treasury yield curves.

Yeah, I know you can get these somewhere else. But why bother when you can get them here?

I'm experimenting with different sizes. I don't want to make them too big, but I also don't want major losses of information.

|

Thu Apr 28, 2005 2:54 pm

Thu Apr 28, 2005 2:54 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

| F fund |

|

|

I sense we are coming into a trend where the F fund should start to post some gains, but I have never understood the fund very well. Therefore, I am reluctant to commit much to it, and I am do not know where I can go to find a trend tool that will issue signals, like you might find in a MACD chart for the other funds. Any help out there

|

Thu Apr 28, 2005 4:15 pm

Thu Apr 28, 2005 4:15 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

| Re: F fund |

|

|

Sarah, so, 85.... 95... 05?

Glad to be G fund today! The equity trend is down. The TSPMoney Signal Light indicator is a board full of flashing red lights for short, medium and long term for the C, S and I funds. The F is yellows and greens.

I am sticking with mostly with G for now, and hope to jump over this valley.

|

Thu Apr 28, 2005 6:22 pm

Thu Apr 28, 2005 6:22 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

Probably more like a Fiduciary Vortex Flushing Wave  This year has been a lot like "The Pit and the Pendulum" with each market swing taking another deadly swipe This year has been a lot like "The Pit and the Pendulum" with each market swing taking another deadly swipe

|

Thu Apr 28, 2005 6:44 pm

Thu Apr 28, 2005 6:44 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| OOOGA! OOOGA! Dive, Dive, Dive! |

|

|

Can a retest of Dow 10,000 be coming up? If that breaks look out below! Go F-Fund! An economic slowdown is in the cards, good for bonds. If oil heads back up it will cut any stock rally short. A stock rally in May will have a lot of headwind to go against in this environment. Dow 9700 is becoming a possiblility if the bulls can't get their act together! Marty.

Top Dog for March and May 06!

|

Thu Apr 28, 2005 6:45 pm

Thu Apr 28, 2005 6:45 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| Sinking further into the Muck! |

|

|

It's gotta be all about a floundering economy. The stock market is smelling something down the road that it doesn't care to feast on. Yes, the markets are oversold, yes, crude may have hit a peak, yes the Fed may relax its stance, but there's something in the air. Could it be, if the Fed relaxes its stance on raising rates, this could spell the spechter of, dare I say it, recession ahead? Marty.

Top Dog for March and May 06!

|

Fri Apr 29, 2005 2:52 pm

Fri Apr 29, 2005 2:52 pm |

|

|

Wheels

Preferred Member

Cash: $ 21.52

Posts: 106

Joined: 17 Mar 2005

Location: Nashua NH

|

| Radical effects of the dollar |

|

|

I guess the effect of the dollar can be more than substantial.

Check out the value of the MSCI FAR EAST funds in local currencies and in U.S. dollars. http://www.msci.com/equity/index2.html (you will have to move the date to the 29th yourself)

Dave

Keep in mind the Nikkei was closed today so I am guessing that this is all about the yuan. Too bad the Hang Seng is such a small portion of the I fund.

|

Fri Apr 29, 2005 5:18 pm

Fri Apr 29, 2005 5:18 pm |

|

|

Rajun Cajun

Preferred Member

Cash: $ 32.17

Posts: 158

Joined: 22 Mar 2005

Location: Texas

|

Sarah,

I haven't been able to post my moves the last week, so please disregard my April tally. Due to getting in this week, I'm now down .60 for the year.

Show me at 40 G 20 CSI as of today. I'll try to get all my May moves in.

Thanks,

RC

|

Sun May 01, 2005 3:04 am

Sun May 01, 2005 3:04 am |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

I have moved into the C fund, as there just has to be a short term recovery here somewhere. As soon as I get it (if it happens) I will jump back to the G fund, as I still beleive the trend is down.

SCRATCH - TOO MUCH RISK

I better stick with the trend, so will stay majority G fund.

Last edited by SkyPilot on Mon May 02, 2005 10:48 am; edited 1 time in total |

Sun May 01, 2005 8:07 pm

Sun May 01, 2005 8:07 pm |

|

|

greg

Senior Member

Cash: $ 127.49

Posts: 609

Joined: 23 Mar 2005

Location: One Monkey Don't Stop No Show

|

| Re: TSP Trader of the Month Award - April 2005 |

|

|

Is this the percentage for TYD or just for the month?

quote:

Originally posted by sarah

It was a difficult month to make a buck in the TSP. One person made one one hundredth of a percent.

WINNER!! dmanos

CONGRATULATIONS DONNIE!!

dmanos +0.01%

SkyPilot -0.92%

Wheels -1.79%

Rolo -2.17%

martyfoley -2.48%

sarah -2.77%

mlk_man -4.71%

|

Mon May 02, 2005 12:21 am

Mon May 02, 2005 12:21 am |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

Looks like futures are up today, so for those invested, there may be some dollars coming your way. In reviewing the stats for last month, If I had stayed with the trend instead of trying to catch the wave for the day, I could have conserved about 1% which would have left me about even for the month. That should teach me...  Almost every time I try to beat the trend, I lose. Almost every time I try to beat the trend, I lose.

|

Mon May 02, 2005 12:19 pm

Mon May 02, 2005 12:19 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

How about, instead of a competition, a team effort  I know I have learned much as a result of others comments and input. Accordingly, we risk according to our tolerance, and sometimes that pays off, sometimes we pay out. When the market swings back up, those who are currently down much will likely reap great returns, and in the end, who's to know how we will end up? I know I have learned much as a result of others comments and input. Accordingly, we risk according to our tolerance, and sometimes that pays off, sometimes we pay out. When the market swings back up, those who are currently down much will likely reap great returns, and in the end, who's to know how we will end up?

At least we are not vicitms of an aribitrary market; we are becoming informed particpants. We pays our money, we takes our chances...

|

Mon May 02, 2005 3:07 pm

Mon May 02, 2005 3:07 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

| Competition vs. Team Effort |

|

|

Everyone will have their own opinions so I can't see us performing as a team in this realm. Competition sharpens the senses, and forces you to look at and learn about the market, so in this vain I think competition is the best. The exchange of idea's, opinions, I think is very helpful in trying to make your allocation decisions. The markets will kill you if you think too short term, so I think you have to understand the trend and go along with it until something happens to change it, then go along with the new trend. I'm still bearish for now, anything can happen of course, but I still do not see us going up thru any resistance at this point in time. Marty.

Top Dog for March and May 06!

|

Mon May 02, 2005 4:12 pm

Mon May 02, 2005 4:12 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

MilkMan, the Fund Surfer has you at -2.62% for April at the other forum.

I am down 3.1% for the year, so, at least I have not increased my losses from the first week of the year. Given this market, I guess that's not too bad.

However, I will need to make about 15% through the end of the year to reach my yearly goal of 11%. Hopefully, we will see the end of 05 act like the end of 04.

|

Mon May 02, 2005 5:24 pm

Mon May 02, 2005 5:24 pm |

|

|

|