SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

Greg wrote:

Tom doesn't do too well when he can't delete posts he doesn't like or puts him in a bad light.

Also, I don't understand how his YTD return is at least 2% below all 5 of the funds. He would be the perfect example of the person that should park all their money in the new L-funds.

SkyPilot wrote: Then Greg, maybe you should post your comments on his site where he is more likely to read it. I don't know that he is a "perfect" example of what you suggest. He has had some success in the past, so pointing out his recent misfortune has little significance or value.

|

Fri Jul 22, 2005 11:57 am

Fri Jul 22, 2005 11:57 am |

|

|

hertfordnc

First Time Poster

Cash: $ 0.20

Posts: 1

Joined: 22 Jul 2005

|

| Newbie bottom line questions |

|

|

Greetings,

In my little corner of the federal govt. folks don't seem to pay much attention to the TSP, if they participate at all. Almost no one does any significant movement between funds and no one around me has much understanding of markets.

What kind of returns are people getting by moving money frequently between funds?

Can someone share some basic strategies with me?

I'm 44 y.o. with ZERO assets (ugly divorce) So i want to be pretty agressive in building this up.

I just drained my meager TSP acct to buy a house (also part of the rebuild strategy) so I have just a few bucks in there so I figure it's a good time to be wreckless and see what works.

Thanks

Dave

|

Fri Jul 22, 2005 1:44 pm

Fri Jul 22, 2005 1:44 pm |

|

|

martyfoley

Senior Member

Cash: $ 66.02

Posts: 404

Joined: 18 Mar 2005

Location: Northeast USA

|

Going 100% G today. I'm going on a little getaway until 7/27/05 and don't like to have to worry about my allocations. It's probably just as well as the markets have had quite a run and may be vulnerable here to some sort of correction. I also didn't like the fact that the markets didn't bounce back strongly today as of yet whereas in the recent past they bounced back strongly after a weak day. Oh well, we'll see how they look next Wednesday, good luck to all. Dave (new member) nice to hear from you. Marty

|

Fri Jul 22, 2005 3:42 pm

Fri Jul 22, 2005 3:42 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

| Re: Newbie bottom line questions |

|

|

quote:

Originally posted by hertfordnc

Greetings,

In my little corner of the federal govt. folks don't seem to pay much attention to the TSP, if they participate at all. Almost no one does any significant movement between funds and no one around me has much understanding of markets.

What kind of returns are people getting by moving money frequently between funds?

Can someone share some basic strategies with me?

I'm 44 y.o. with ZERO assets (ugly divorce) So i want to be pretty agressive in building this up.

I just drained my meager TSP acct to buy a house (also part of the rebuild strategy) so I have just a few bucks in there so I figure it's a good time to be wreckless and see what works.

Thanks

Dave

What kind of returns? From really good, to really poor, depending on the time span in question, and the method or strategy (or lack of it) as the case may be. Actually "Buy and Hold" with a diverse allocation has been doing pretty well this year so far, but it doesn't do well in down markets if you really need to maximize your funds, i.e. the more risk, usually the more "potential" reward. The trick is not how often you move, but why you move when you do, and what will prompt the next move. Good luck...

|

Fri Jul 22, 2005 4:45 pm

Fri Jul 22, 2005 4:45 pm |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

| Re: The New Normal |

|

|

quote:

Originally posted by SkyPilot

Well folks, even though the markets were down today, I suspect all things being equal, we will see a rebound tomorrow.

Here we are, with a substantial rebound. So, as we go forward, it might be a mistake to sell on the news of more attacks, when before it would have been a certainty that one should.

The sky is not falling... I don't think, well maybe....

|

Fri Jul 22, 2005 9:36 pm

Fri Jul 22, 2005 9:36 pm |

|

|

greg

Senior Member

Cash: $ 127.49

Posts: 609

Joined: 23 Mar 2005

Location: One Monkey Don't Stop No Show

|

In retaliation for my comment posted here pointing out the obvious, Tom (the little baby) disabled my ability to post and PM on his site.

That's cool, I'm better off !

|

Sat Jul 23, 2005 4:47 pm

Sat Jul 23, 2005 4:47 pm |

|

|

greg

Senior Member

Cash: $ 127.49

Posts: 609

Joined: 23 Mar 2005

Location: One Monkey Don't Stop No Show

|

Sarah,

As of this morning, our little-baby friend Tom disabled my ability to read the message board on his swell site. Are you in the boat?

He did all of this without ever bothering to email me telling me that he was doing any of this nor stating the reasons why (so much for customer service). I'll be putting in a claim at PayPal saying that I want back the money that I donated to his site.

It's no wonder that people kiss-up to him on his site. It's not because of his worthwhile fund-trading advice.

Greg

|

Mon Jul 25, 2005 10:51 am

Mon Jul 25, 2005 10:51 am |

|

|

SkyPilot

Senior Member

Cash: $ 100.11

Posts: 492

Joined: 13 Mar 2005

|

| More good news for I fund open this AM |

|

|

The Euro is also up against the USD

|

Mon Jul 25, 2005 12:18 pm

Mon Jul 25, 2005 12:18 pm |

|

|

trisha

Preferred Member

Cash: $ 33.75

Posts: 164

Joined: 21 Mar 2005

Location: NW Ark

|

quote:

Originally posted by greg

In retaliation for my comment posted here pointing out the obvious, Tom (the little baby) disabled my ability to post and PM on his site.

That's cool, I'm better off !

Greg, are you a journalist by nature? A direct, non-inflammatory report would have been to simply say you were not longer able to post & PM there. This post raised a suspicion that you had already been requested to leave that site; this morning's post, 7/25, rather confirms it. Let's not let this site get contaminated with whisperings & unnecessary adjectives.

Thank you.

|

Mon Jul 25, 2005 2:44 pm

Mon Jul 25, 2005 2:44 pm |

|

|

Jonathan

Member

Cash: $ 4.05

Posts: 20

Joined: 22 Apr 2005

|

Wow. I leave for a little while, and all sorts of fun happens

I've gone 100% G as COB Friday -- the F-fund is trending down, and if historical trends hold, that will be followed by downward action in the equities.

And if not, hey, I don't retire for another 35 years or so!

|

Tue Jul 26, 2005 1:48 pm

Tue Jul 26, 2005 1:48 pm |

|

|

Jonathan

Member

Cash: $ 4.05

Posts: 20

Joined: 22 Apr 2005

|

|

|

|

quote:

Originally posted by sarah

quote:

Originally posted by Jonathan

Wow. I leave for a little while, and all sorts of fun happens

I've gone 100% G as COB Friday -- the F-fund is trending down, and if historical trends hold, that will be followed by downward action in the equities.

And if not, hey, I don't retire for another 35 years or so!

Jonathan, I'm curious. Where did you find this historical trend? I've never heard of it. According to the Stock Trader's Almanac, if July is bullish it usually ends well. August is another story.

It's pretty recent by "historical" standards, so I probably should have said "my recent observations".

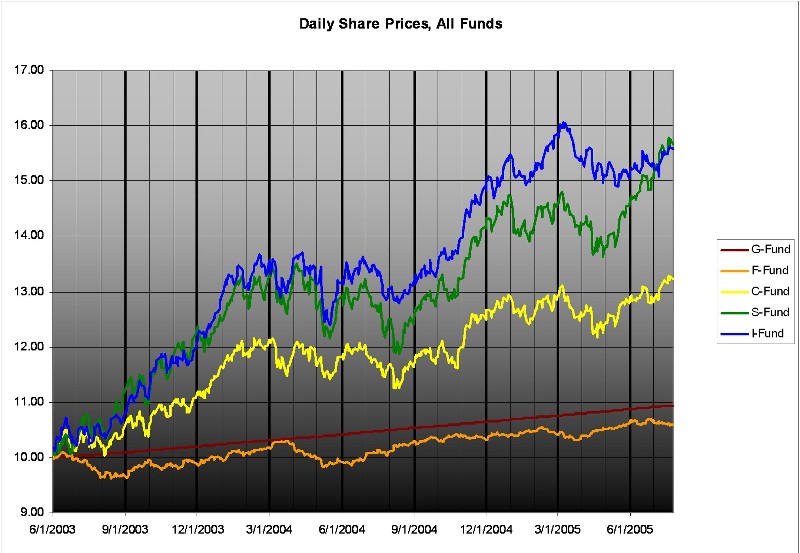

I mentioned it once before...basically, trends in the F-fund, at least since mid-2003, appear to presage trends in the equities by a week to a month.

The F-fund is down from its arithmetic average over the last 50 days, but the downturn isn't as great as it has been in the past at times, either, so who knows?

Time will tell whether or not the trend holds, and yeah, it's simplistic. It's just something I noticed.

|

Tue Jul 26, 2005 6:14 pm

Tue Jul 26, 2005 6:14 pm |

|

|

Jonathan

Member

Cash: $ 4.05

Posts: 20

Joined: 22 Apr 2005

|

| Re: C vs F funds |

|

|

quote:

Originally posted by sarah

While bonds and stocks have some general cyclical qualities, historically, I can't find a general tendency for equities to follow bonds down...or up..

The following are the returns of the C and F funds from 1980 to 2004.

80: C 32, F 3

81: C -5, F 6

82: C 21, F 33

83: C 22, F 8

84: C 6, F 15

85: C 32, F 22

86: C 19, F 15

87: C 5, F 3

88: C 17, F 8

89: C 31, F 15

90: C -3, F 9

91: C 28, F 15

92: C 8, F 7

93: C 10, F 9

94: C 2, F -3

95: C 32, F 17

96: C 21, F 4

97: C 30, F 9

98: C 28, F 8

99: C 20, F -1

00: C -11, F 9

01: C -11. F 8

02: C -23, F 10

03: C 26, F 4

04: C 10, F 4

That's interesting, Sarah. Like I said, the observed trend may be nothing; it's certainly not based upon long-term data.

It's also possible, though, that the trend is fairly noisy and short-term, and lost in longer-term (e.g. yearly return) data...

UPDATE:OK, so I just ran a correlation between the F- and C-Fund monthly returns going back to 1988 or so. The strongest correlation between the two was within the same month, and it wasn't terribly strong: .18. Offsetting the data sets by one month either way, however, produced an essentially zero correlation (less than .05).

So from a historical standpoint, the observation doesn't seem to hold up.

|

Tue Jul 26, 2005 7:10 pm

Tue Jul 26, 2005 7:10 pm |

|

|

drinkoj

Preferred Member

Cash: $ 21.35

Posts: 106

Joined: 27 Jul 2005

Location: SC

|

Great to find others managing their TSP funds regularly and now I can see how others are moving funds.

I'll be moving my G 90% into the C,S,I funds (80,10,10) once the DOW drops to the 10400 to 10450 mark, trying to come out ahead of the July 11th sell I had out of the C Fund ($13.12 per share). Sold too early and now trying to just lick my wounds and deal with my $0.02 per share return vs +/-$0.13+/- per share I could of had.

|

Wed Jul 27, 2005 7:56 pm

Wed Jul 27, 2005 7:56 pm |

|

|

Wheels

Preferred Member

Cash: $ 21.52

Posts: 106

Joined: 17 Mar 2005

Location: Nashua NH

|

When will this market relent? I'm one of those people that have been parked in the G fund all month. Not because I adore the security but simply because I have been expecting a pullback. I am still expecting it and I am going to stay put for at least a little while longer but man this month has been tough to watch.

Dave

|

Thu Jul 28, 2005 6:19 pm

Thu Jul 28, 2005 6:19 pm |

|

|

drinkoj

Preferred Member

Cash: $ 21.35

Posts: 106

Joined: 27 Jul 2005

Location: SC

|

Yeah, I moved to 90% G Fund on 7/11 expecting a drop by the end of July, and BOY WAS I WRONG. Decided to sell off the remaining 10% and move it to G Fund for tomorrow, as after two consecutive record days for the US markets there is going to be a sell off through next Tuesday, IMHO.

I'll buy back 10% into the C,S,I next week and still hold back until the Dow hits the 10450 mark (I use that as a simple bench mark, as I know the markets the funds follow). Might pick up a little extra % on the S Fund if things "feel" right. As I noticed the trends showing August to be weaker month too.

The question I have is about the I Fund. The dollar is lower to the Euro and even with the Yen, and oil continutes to ping pong around the 60 mark; is the I Fund ready for a breakout August month? Just reading about the new energy bill, wondering how that will effect the market too. I mean Bush's got to protect his oil fields, I mean the country.

|

Thu Jul 28, 2005 10:32 pm

Thu Jul 28, 2005 10:32 pm |

|

|

|