| 401k and thrift savings plan ? |

|

|

|

|

|

jim2k

New Member

Cash: $ 1.10

Posts: 5

Joined: 29 Apr 2011

|

| 401k and thrift savings plan ? |

|

|

My scenario. I have a job with a 401 k which I put in the max amount that I can . I Also am in the USAF reserves and have thrift savings plan account. My question is there any tax benefit for me to just put the 100% reserve pay into the thrift savings plan. Since I do not need it. Also when I do my taxes the reserve pay lowers the amount I get back from the government

Thanks for any advice

Jim2k

|

Wed Apr 24, 2013 1:05 am

Wed Apr 24, 2013 1:05 am |

|

|

jim2k

New Member

Cash: $ 1.10

Posts: 5

Joined: 29 Apr 2011

|

Coaster

I agree totally with your statement and try to only give back a little but this time I was getting a small refund which I could,ve used to offset me paying money to 2 states that I owed. I,ll check out w-4 calculator thanks

|

Wed Apr 24, 2013 6:11 pm

Wed Apr 24, 2013 6:11 pm |

|

|

oldguy

Senior Member

Cash: $ 751.85

Posts: 3656

Joined: 21 May 2006

Location: arizona

|

jim2k - the rules of the two plans are nearly identical - ie, a $17,500 limit, the pre 59 1/2 age penalty, and the RMD at age 70 1/2. So your tax bill is the same for either plan (or if you split between the 2 plans).

Normally you'll have more & better choices in the 401k plan (but that depends on your company) - the TSP has only 5 choices.

quote:

Also when I do my taxes the reserve pay lowers the amount I get back from the government

No. Like Tim said, you are probably getting wrapped around the axle with the difference between 'tax refund' and 'tax bill'. (I always make certain that I OWE money on April 15, that way I don't have to worry about a refund, lol)

|

Wed Apr 24, 2013 10:58 pm

Wed Apr 24, 2013 10:58 pm |

|

|

jim2k

New Member

Cash: $ 1.10

Posts: 5

Joined: 29 Apr 2011

|

Oldguy

If there almost the same does that mean I can put a max 17500 in both or a total of the 2 . The income for both the 401 k and tsp are from separate jobs

Thanks

|

Thu Apr 25, 2013 1:37 am

Thu Apr 25, 2013 1:37 am |

|

|

oldguy

Senior Member

Cash: $ 751.85

Posts: 3656

Joined: 21 May 2006

Location: arizona

|

The $17,500 is your total allowance - you can split the two anyway you like - but you can't double it. BTW, the $17,500 limit applies to the employee contribution, any employer 'match' is in addtion to $17,500.

|

Thu Apr 25, 2013 2:07 pm

Thu Apr 25, 2013 2:07 pm |

|

|

clydewolf

Senior Member

Cash: $ 50.25

Posts: 248

Joined: 27 May 2012

|

| Re: 401k and thrift savings plan ? |

|

|

quote:

Originally posted by jim2k

My scenario. I have a job with a 401 k which I put in the max amount that I can . I Also am in the USAF reserves and have thrift savings plan account. My question is there any tax benefit for me to just put the 100% reserve pay into the thrift savings plan. Since I do not need it. Also when I do my taxes the reserve pay lowers the amount I get back from the government

Thanks for any advice

Jim2k

Interesting situation.

If your top tax bracket is 15%, I suggest you contribute to a ROTH IRA.

The USAF pay could be used to fund a ROTH IRA up to $5,500 for you and then you could do that again for your spouse.

You can compare the ROTH (after tax) IRA and a Traditional IRA (before tax) here:

https://investor.vanguard.com/what-we-offer/iras/traditional-iras-and-roth-iras

At this time the TSP does not have a ROTH plan. Your 401k may or may not have a ROTH plan. Still the ROTH IRA is likely your best choice.

|

Fri Apr 26, 2013 7:31 pm

Fri Apr 26, 2013 7:31 pm |

|

|

Anton Martin

Full Member

Cash: $ 15.00

Posts: 73

Joined: 23 Nov 2012

Location: Florida, USA

|

I suggest you to get tax expert advice on why you are getting less tax refunds, it is possible that there may be errors in your filing process.

|

Wed May 29, 2013 12:12 pm

Wed May 29, 2013 12:12 pm |

|

|

soybean

Full Member

Cash: $ 14.65

Posts: 83

Joined: 29 Jun 2011

Location: Ohio

|

quote:

Originally posted by oldguy

Normally you'll have more & better choices in the 401k plan (but that depends on your company) - the TSP has only 5 choices.

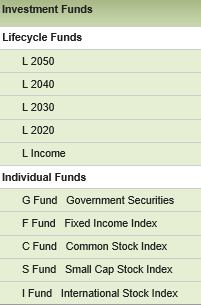

Actually, TSP is quite flexible. As the inserted image shows, it offers 5 Individual Funds but you can create any mixture of those funds. Or, you can choose one or more of the Lifecycle funds or you could have a mixture of Individual Funds and Lifecycle Funds. And, the mix can be changed anytime, with a limit on the number of changes allowed per month.

|

Thu May 30, 2013 4:23 pm

Thu May 30, 2013 4:23 pm |

|

|

Brownsfan2k5

Full Member

Cash: $ 20.90

Posts: 93

Joined: 27 Feb 2013

Location: Military

|

The TSP does offer a Roth TSP now. Also one thing to consider is that the TSP has extremely low fees. It's something like 25 cents for every $1000 contributed.

|

Thu May 30, 2013 11:06 pm

Thu May 30, 2013 11:06 pm |

|

|

clydewolf

Senior Member

Cash: $ 50.25

Posts: 248

Joined: 27 May 2012

|

quote:

Originally posted by Brownsfan2k5

The TSP does offer a Roth TSP now. Also one thing to consider is that the TSP has extremely low fees. It's something like 25 cents for every $1000 contributed.

Thanks for that correction! In fact the ROTH option to the TSP has been available since May of 2012!

The ROTH option for the TSP was rolled out over time during 2012 for agencies and the active military. In 2013 the ROTH Option will be/is (I can not find a schedule) for Reserve military members.

To the OP: The TSP ROTH would be a good choice for you. Any matching contributions will be in a traditional account.

If you are making a spousal contribution you would need to make that to a ROTH IRA.

Right now the TSP and 401k administrators are waiting for the IRS folks to work out guidelines for converting to a ROTH within the respective plans.

|

Sat Jun 01, 2013 8:52 pm

Sat Jun 01, 2013 8:52 pm |

|

|

Brownsfan2k5

Full Member

Cash: $ 20.90

Posts: 93

Joined: 27 Feb 2013

Location: Military

|

Will do!

|

Sun Jun 02, 2013 10:28 pm

Sun Jun 02, 2013 10:28 pm |

|

|

Radix3d

Preferred Member

Cash: $ 21.60

Posts: 105

Joined: 20 Mar 2013

|

You can withdraw from your TSP account at age 55 penalty free which I believe to be younger than other retirement plans? I think you have to be in your 60's with anything else?

https://www.tsp.gov/lifeevents/entering/enteringRetirement.shtml

Also, you should be able to contribute to a roth ira tax free in and tax free out if you are receiving hostile fire pay. Go somewhere like UAE and max out your Roth  . .

http://paycheck-chronicles.military.com/2010/08/16/you-should-contribute-to-a-roth-ira-while-you-are-in-a-combat-zone/

Every Air Force base that I've been to has a financial advisor that is going to know a lot about the TSP and other retirement plans. I would make an appointment with them. If you get into financial trouble you'll be forced to go there by your commander lol.

Also, if I remember correctly, the TSP strats you out in the G fund which is gov. securities. NOT the place you wana be right now so make sure to change that.

|

Mon Jun 03, 2013 2:29 am

Mon Jun 03, 2013 2:29 am |

|

|

pezlindalo

New Member

Cash: $ 2.00

Posts: 7

Joined: 13 Aug 2013

|

Thrift savings plans or TSP are tax deferred retirement savings and investment plans administered by the Federal Retirement Thrift Investment Board or FRTIB for federal employees. Thrift savings plans work on the same principle as 401 (k) plans offered by many private employers. All the employees who fall under the Federal Employees Retirement System or FERS and the Civil Service Retirement System or CSRS are eligible to participate in TSP. There are different requirements specified for both FERS and CSRS groups. Federal employees have to make voluntary contributions to their TSP accounts. Additionally, these contributions are not in any way considered a part of their regular FERS Basic Annuity or CSRS annuity contributions.

|

Tue Aug 13, 2013 9:50 am

Tue Aug 13, 2013 9:50 am |

|

|

|